- The "esports winter" refers to layoffs and financial setbacks shaking the industry since late 2022.

- Coined by VentureBeat, the term reflects declining investments and rising doubts about esports sustainability.

- Stakeholders must assess root issues and explore new models to revive long-term industry growth.

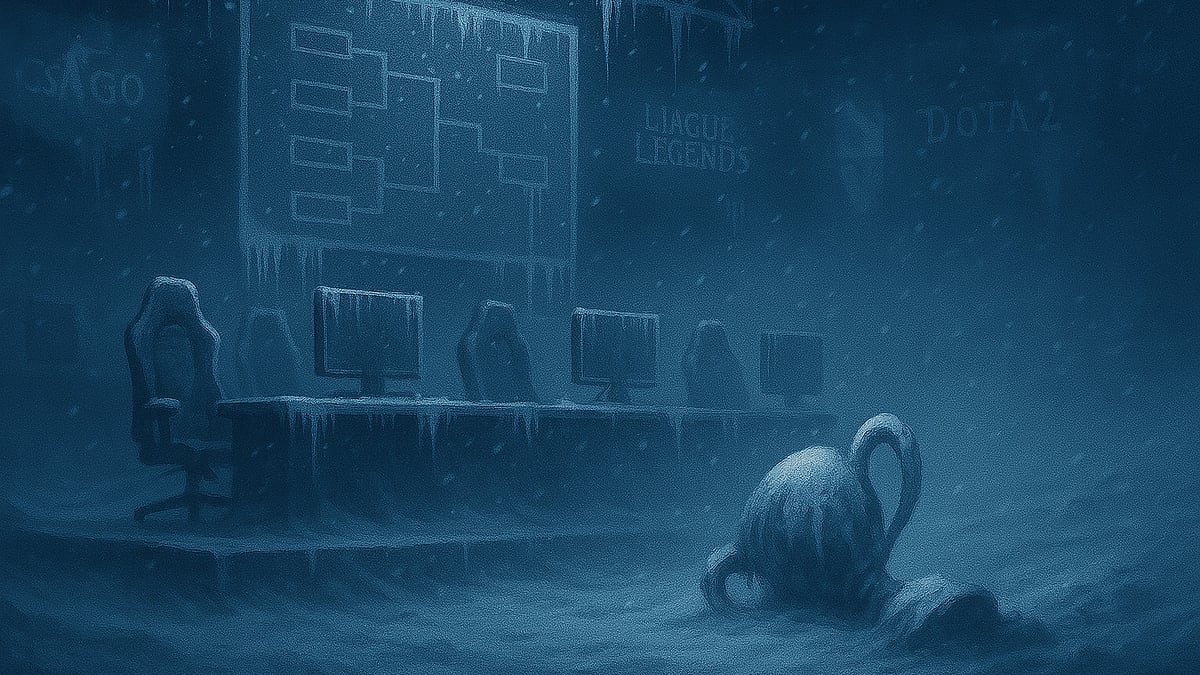

The esports industry faces a downturn that industry observers call the "esports winter." VentureBeat journalists Jordan Fragen and Erron Kelly first coined the term in late 2022 after the esports industry experienced a series of layoffs and financial losses that raised questions about its future.

Understanding what the esports winter is, why it happens and what stakeholders can do about it requires examining the industry's recent struggles and potential solutions.

What Is the Esports Winter?

The esports winter refers to a challenging phase for the industry marked by widespread layoffs, company closures and financial struggles. Since late 2021, esports organizations, media outlets and tournament organizers have faced significant setbacks.

Prominent organizations including Counter Logic Gaming, The Guard and eUnited have shut down. Others report annual losses in the millions of dollars.

The period contrasts sharply with the booming investment years of the late 2010s. Recent times have seen sponsors and investors pull back. BMW reduced esports sponsorships in some regions in 2023, according to Sports Business Journal.

The job market reflects this turmoil. Gaming industry jobs dropped 19% from 2021 to 2022, according to Hitmarker, a gaming industry job board.

The esports winter's impact varies across the industry. Smaller organizations struggle most, as staying profitable in esports proves difficult. Larger companies are better positioned to endure downturns but face significant challenges from industry shifts.

What Caused the Esports Winter?

Three main factors drive the esports winter.

Unsustainable business models: Many esports organizations rely heavily on sponsorships, according to Fragen and Kelly. This dependence creates vulnerability when sponsors, drawn by initial hype, quickly withdraw their support. The volatility makes building sustainable businesses around sponsorship revenue difficult.

Publisher control: Game publishers such as Riot Games and Valve control their titles' ecosystems, from development to broadcasting decisions. Unlike traditional sports, where no single entity owns the game, publisher choices can disrupt esports scenes.

Publishers prioritize revenue from their base games over esports, often sidelining competitive ecosystems. Activision Blizzard shut down the Overwatch League in 2024 as the company shifted focus away from the league amid declining viewership. The company introduced a new Champions Series, but it failed to retain the same level of enthusiasm and viewership.

Economic pressures: Rising inflation and recession fears have affected multiple industries, reducing sponsorship and investment. This leads to layoffs within the esports industry and accelerates the winter conditions.

How Can Esports Navigate the Cold?

Emerging from the esports winter requires innovative strategies and diversified revenue streams.

Content creation has become a popular choice for esports organizations seeking to diversify revenue. Organizations are exploring merchandising, digital items and educational courses to create alternative revenue sources.

Esports organizations should build their identity around fans and the organization itself rather than star players, whose departures can damage brands.

Improving accessibility presents another opportunity. Many esports titles remain inaccessible to casual audiences. League of Legends, Dota 2, Overwatch and Apex Legends are examples of games where first-time viewers may struggle to enjoy esports events.

Publishers and tournament organizers could focus on storytelling-driven approaches to make esports content more accessible to viewers.

Revenue sharing offers another path forward. Stakeholders could push for fairer revenue splits from publishers for esports-related in-game items.

Electronic Arts initially offered esports organizations in its Apex Legends Global Series circuit a flat $60,000 fee for in-game esports skins in 2023 instead of a revenue-sharing model, according to Digiday. Several esports organizations negotiated and received more favorable deals.

Esports organizations should seek more sustainable ecosystems from game publishers. Independent revenue streams, less tied to publisher decisions, can help organizations adapt without losing fans.

Author

Abhimannu Das is a web journalist at Outlook India with a focus on Indian pop culture, gaming, and esports. He has over 10 years of journalistic experience and over 3,500 articles that include industry deep dives, interviews, and SEO content. He has worked on a myriad of games and their ecosystems, including Valorant, Overwatch, and Apex Legends.

Abhimannu Das is a web journalist at Outlook India with a focus on Indian pop culture, gaming, and esports. He has over 10 years of journalistic experience and over 3,500 articles that include industry deep dives, interviews, and SEO content. He has worked on a myriad of games and their ecosystems, including Valorant, Overwatch, and Apex Legends.

Related Articles