The Scarcity Spike: Resale tickets for BTS' Goyang homecoming hits an astounding price of $7000+ as Arirang World Tour begins its global run.

How BTS Concerts Fuel the High-Stakes Resale Economy

A closer look at how BTS’ Goyang concerts in South Korea mirror the size and complexity of the K-pop resale market.

- Scarcity and global demand propelled BTS Goyang resale tickets up to 40x face value.

- This inflation indicates a strongly tiered K-pop resale system, with upper-tier seats commanding more than $1,100 in price.

- This scarcity-driven booming resale industry, which includes tickets, merchandise and more, is additionally fueling government regulatory debates around the world.

BTS' return to the concert arena in April 2026, with three sold-out shows at Goyang Main Stadium on April 9, 11, and 12, is more than just a big cultural event. The group’s homecoming has additionally grown into a microcosm of the thriving resale economy centered on K-pop tickets and related commodities (like K-pop merch, albums, and other collectibles), merging scarcity, worldwide demand, and fan excitement that is driving a flourishing aftermarket.

Official tickets for the BTS Goyang concerts were priced in the mid-range by current K-pop standards, with premium seats topping around 264,000 KRW (~ ₹16,684.38 or $181.97 USD). However, secondary markets have seen listings jump to near about 40-plus times the face value. On worldwide resale marketplaces like StubHub, the closest floor tickets were advertised at about ₹6.65 lakh (~$7,260) for April 9 and 11, while a high-demand portion for April 12 rose above ₹5.14 lakh (~$5,610). Upper-tier listings depicted a price that is worth over ₹1 lakh (~$1,130), indicating a significantly higher cost than the original advertised amount. Below is the StubHub data showcasing minimum and maximum resale ranges per date:

- April 9: ₹1,40,983 to ₹6,65,583 (~ $1,538 to $7,262)

- April 11: ₹2,23,675 to ₹6,65,583 (~ $2,440 to $7,262)

- April 12: ₹1,04,169 to ₹5,14,467 (~ $1,136 to $5,613)

- Overall resale span: ₹1,04,169 to ₹6,65,583 (~ $1,136 to $7,262).

This shows that April 11 is the most supply-constrained date, with even the cheapest listings reaching ₹2.2 lakh (~ $2,440), highlighting how mid-run shows generally experience peak resale demand. This echoes a larger trend in K-pop, in which secondary market markups push prices thousands of dollars higher than face value, substantially disturbing the primary market.

Secondary Resale Prices Reveal Tier-wise Demand

StubHub resale price data also reveals a layered market:

- Premium Floor / VIP: ~$4,180 average (avg): Sections like W-F4, S-F3, and N-F3 depict the highest markups.

- Side-Stage / Lower Tiers: ~$3,332 avg: Sections such as E-F10, S-F8, and N-F7 are popular but are much less sought after than real floor seats.

- Standard Lower Tier: ~$1,916 avg: This segment here has a consistent midrange resale price range.

- Upper Tier to Budget Entry: ~$1,136 avg: This portion serves as the benchmark for reselling prices for this run.

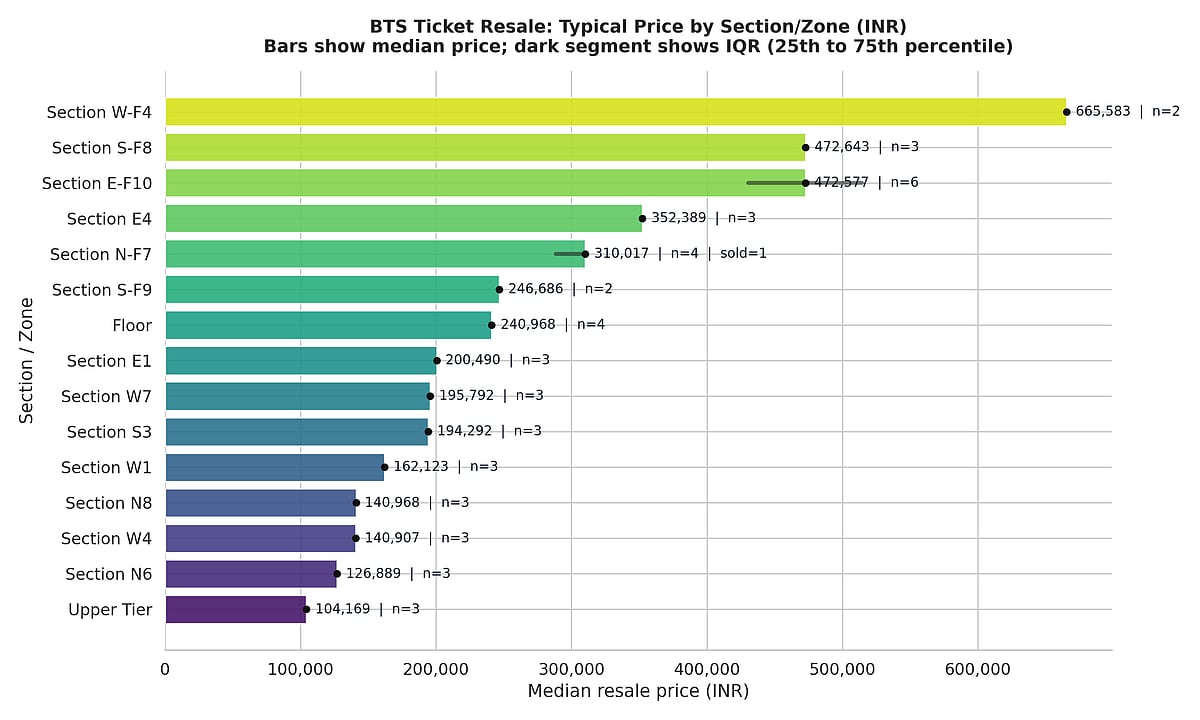

This depicts that BTS resale pricing has a definite, tiered structure with costs increasing with better positions. Floor tickets averaged $4,000 and upper-tier sections cost more than most Western artists charge for' best seats. Essentially, the upcoming Arirang 2026 tour has successfully filtered out of the 'cheap' ticket category benefitting from the band’s popularity. Below is a chart which displays the typical price for each segment, excluding highly expensive offerings:

Image credit: Digitally rendered for this article.

The dark lines in the chart immediately above represent how much prices vary. Short lines indicate that prices remain stable, but lengthy lines indicate that they fluctuate significantly. W-F4, S-F8, and E-F10 are the most expensive, with E-F10 having the largest price difference.

Demand Beyond South Korea and BTS: K-pop’s Global Secondary Ticket Ecosystem

BTS' Arirang world tour 2026, which begins in Goyang and spans five continents, has already witnessed numerous shows sell out soon after the sale went live. Now, resale markets are jumping in to soak up surplus demand. Other global reselling platforms other than StubHub, like Vivid Seats, and more local Korean second-hand sites have also allegedly posted high price listings.

According to Digital Music News, in North America, the starting pricing of the BTS world tour in Los Angeles is reportedly to be around $431, along with a median asking price of $2,386. Industry reports have also noted an average listing range of $1,322 to $4,439 in other American cities. Meanwhile, in regions like Toronto, tickets are projected to have a resale value of at least $1,000, especially since all events in the economic hub of Canada have sold out.

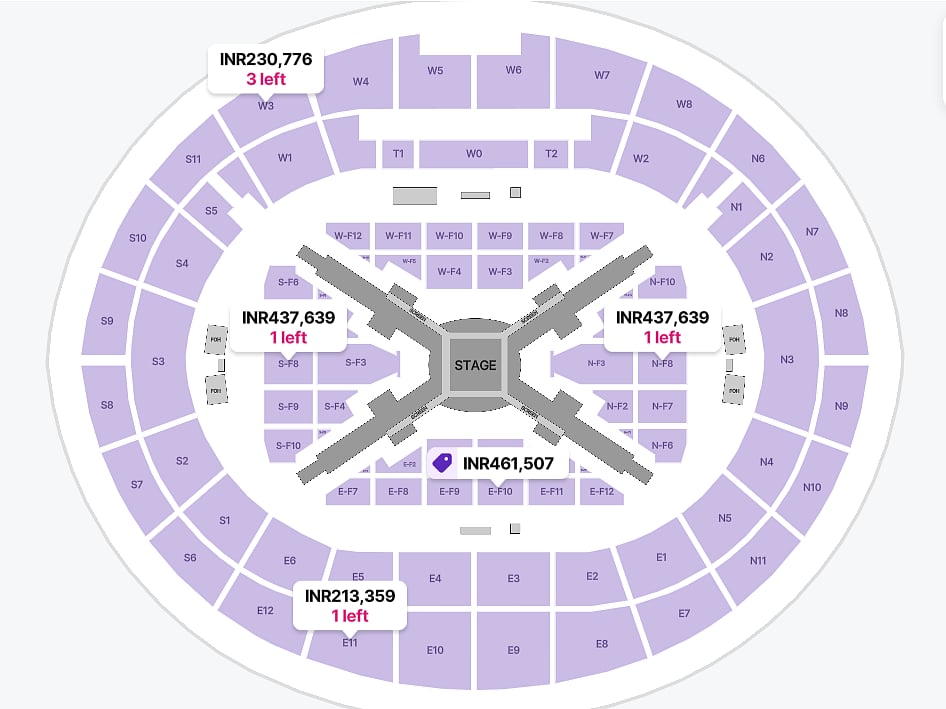

Screen capture from StubHub: BTS April 9, Goyang Concert

A market study into the secondary ticketing business from Global Growth Insights, reveals that high-profile performances frequently command high resale prices. Ticket costs for events involving global acts like BTS, can soar by 40% or more above face value. Notably, concerts account for around 35% of the global secondary ticket market, reflecting the prominence of live shows in resale activity.

Additionally, last year, a Korean media outlet reported that the most premium priced scalped ticket belonged to NCT WISH's first solo concert in Nov 2025. A ticket from that concert with a face value of 198,000 KRW (~ $136.48) was listed for up to 9.7 million KRW (~ $6,686.01) on a resale market.

Furthermore, tickets to aespa and NCT Doyoung's concert in 2025 were also resold for around 8M KRW (~ $5,514.24) each. On the other hand, BLACKPINK's DEADLINE July concert in South Korea traded overseas for roughly 3.04M and 4.74M KRW (~ $2,095.41 to $3,267.19), while its original price was marked at 275,000 KRW (~ $189.55)

BLACKPINK

Why Do K-pop Resale Markets Soar Higher Than Normal Ones?

Several structural elements continue to fuel resale activity surrounding K-pop performances. Tours frequently have restricted dates in each city or region, concentrating enormous fan bases on a tiny pool of tickets while drastically limiting supply. Fan club presales and ID verification systems, which tend to prioritize loyal members, can result in sold-out events in minutes, rendering thousands of fans without the opportunity and driving them to resellers.

Simultaneously, despite legislative limits in countries such as South Korea, scalping and bot-driven trades continue to thrive globally, raising prices even more. The end result is a highly volatile secondary market in which fans, speculators, and professional resellers collide, and ticket prices frequently skyrocket much above the genuine cost of the live performance.

Beyond Tickets: K-pop Merchandise, Albums, and Recommerce Traffic

The influence extends beyond tickets to the resale of K-pop items and media, which is primarily fueled by the so-called BTS effect. In 2025, a South Korean secondhand marketplace, Bunjang Global saw a 280% increase in BTS-related goods purchase, driven by buyers abroad, as photo cards, rare editions, and clothes circulated globally via secondary sales.

Bunjang also saw significant increases in foreign users and transaction volumes, with K-pop items accounting for a major portion of cross-border resale activity, as covered in their recent report. This trend exemplifies a broader cultural commerce trend where K-pop fans not only value official products, but also actively trade them as secondary assets, where constraint drives both artistic investment and practical market worth.

What’s Next for the Resale Economy?

Policymakers are taking note of the growth of ticket and merch resales within pop-culture, including the K-pop sector. This dramatic increase in resale prices has sparked debates in numerous nations, including the United Kingdom, prompting stakeholders to think about how to regulate secondary markets and safeguard fans. Following massive resale price hikes for artists like Harry Styles, and Taylor Swift, the U.K. government suggested limiting resale prices at 30% above face value.

Efforts to reduce reselling are gaining traction, whether through greater platform authentication, tougher anti-scalping regulations, or technological fixes like blockchain-based ticketing. Nonetheless, the core friction between fan access and market speculation is likely to continue, defining the economics of live entertainment throughout the K-pop boom.

BTS as a Market Catalyst

BTS' April shows in Goyang, South Korea, illustrates how a single internationally recognized act may impact numerous sectors of the live entertainment industry. The activity involving resale, from tickets to merchandise, indicates how scale and fandom intensity are increasingly influencing market behavior. As K-pop's worldwide reach grows, these dynamics are likely to become the norm for how large tours are consumed, traded, and valued.

Author

Diya Mukherjee is a Content Writer at Outlook Respawn with a postgraduate background in media. She has a passion for writing content and is enthusiastic about exploring cultures, literature, global affairs, and pop culture.

Related Articles