SM Entertainment's NEXT 3.0 strategy emphasizes global M&A, music rights through KMR, and a new "Multi-Creative" production system.

SM’s NEXT 3.0 Strategy Pushes for M&A, Music Rights and Fan Power

SM Entertainment is betting on music rights, lifestyle goods, and digital fan platforms to gain sustained market dominance.

- SM Entertainment is speeding up mergers and acquisitions to broaden its global music and publishing portfolio.

- Through concerts, retail, and platforms such as DearU, SM is generating fan-driven revenue.

- SM's early Q3 2025 profit improvement, bolstered by Kakao’s support, adds to the company's NEXT 3.0 push for future growth.

SM Entertainment Co., one of South Korea's biggest K-pop entertainment corporations, is boosting merger and acquisition activity and growing fan-focused company investments under its recently announced NEXT 3.0 growth strategy. As noted by Music Business Worldwide, the new strategy is a planned move for deploying capital effectively in music licensing, publishing, and digital engagement to strengthen its global footprint, according to officials’ statements, given on Jan 20, 2026.

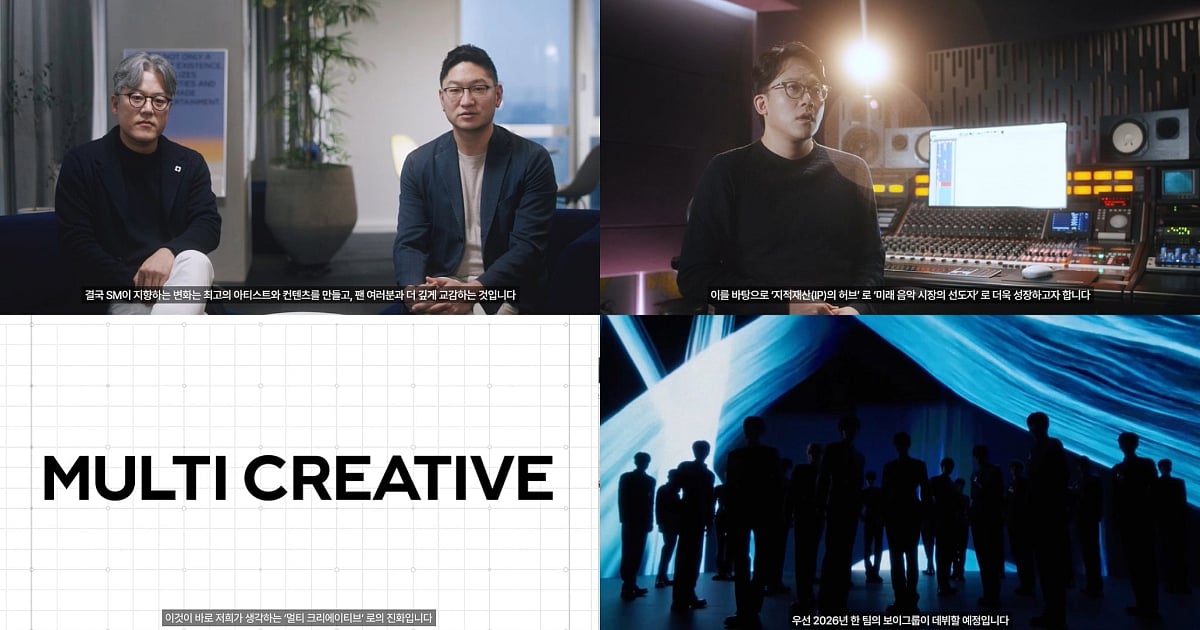

At a strategy briefing, co-CEOs Jang Cheol-hyuk (Daniel Jang) and Dmitry Y.J. Tak stated that SM will actively look for M&A opportunities in music and related sectors, as well as increase capital investment to speed up growth. This decision shifts the company's focus from organic expansion to deal-making and strategic acquisitions throughout the entertainment value chain.

SM Entertainment

M&A and Publishing Scale of SM Entertainment

Kreation Music Rights (KMR), SM’s publishing arm, is one of the significant areas in the company's acquisition plan. KMR oversees a collection of over 7,000 songs and has sub-publishing agreements with over 370 songwriters globally. SM officials highlighted KMR as a crucial platform for subsequent publishing deals, with Chief A&R Officer Chris Lee stating that the organization aims to become "Asia's largest and most respected publishing company" within five years, thus, growing “further as a hub for intellectual property (IP),” while also leading to shape “the future of the music market.”

The emphasis on rights and publishing mirrors a broader commercial trend. Music intellectual property has emerged as an extremely valuable asset class for entertainment and investment enterprises, providing recurrent royalty streams and diverse revenue in the face of market turbulence.

SM Entertainment

Fan Engagement and Platform Expansion of SM

Beyond music license acquisitions, SM is reacting to changing fan consumption patterns by putting live concerts and products at the heart of its growth strategy. Jang stated that live events are "critical" as SM strives to provide regionally customized concert experiences, while merchandising will grow as a lifestyle medium through which fans can "experience an artist's universe."

Notably, SM Entertainment has also acquired DearU, the operator of the superfan platform Bubble, thus making it an affiliated subsidiary of the organization. SM further aims to expand cooperation with global platforms to increase fan engagement and disseminate K-content abroad.

SM Entertainment’s Financial Traction and Strategic Backing

SM's most recent quarterly results show early progress from its diverse strategy. In Q3 2025, the company's operating profit increased by 261.6% year-on-year to ₩ 48.2 billion (~ $34.8 million USD) as reported by Asia Business Daily. The profit rise is said to be led by blockbuster albums, concert income, and DearU growth. Reportedly, the major artists of the company, such as NCT DREAM, aespa, and NCT WISH achieved million-seller status during this period.

The expansion plan is supported by SM's main shareholders, Kakao Corp. and Kakao Entertainment, who collectively own over 40.28% of the company. Their investment seeks to incorporate improved AI capabilities for music services and increase catalog monetization.

SM's NEXT 3.0 strategy, which includes M&A, IP monetization, and fan-centric platforms, intends to prepare the company for enduring global competition. The approach aligns with a broader trend in K-pop, where corporations are creating integrated content ecosystems and fostering lifestyle-driven fan engagement, thus generating substantial revenue for them.

Author

Diya Mukherjee is a Content Writer at Outlook Respawn with a postgraduate background in media. She has a passion for writing content and is enthusiastic about exploring cultures, literature, global affairs, and pop culture.

Related Articles