Matthew Ball’s 2025 report reveals a shrinking gamer pool

The Video Game Industry is Losing Players to TikTok and AI Apps

Gaming participation is shrinking across the world's biggest markets while consumer spending on TikTok, OnlyFans, sports betting, and AI apps has exploded, according to Matthew Ball's latest report.

Highlights

- Gamers are shifting to short-form video and AI, causing player populations to shrink across major global markets.

- Despite high revenue, PC and console spending has stalled as mobile apps hijack traditional gaming time.

- Publishers are squeezing a smaller player base with heavy microtransactions and live-service grinds to cover costs.

The video game industry is officially losing its grip on our free time. Instead of logging hours into the latest blockbuster releases, players are increasingly migrating toward short-form videos, AI tools, and other rapid-fire digital distractions. According to an early access release of Epyllion's State of Video Gaming in 2026 from games industry analyst Matthew Ball, this massive shift in the attention economy has stalled consumer spending and forced the games industry into a compounding crisis. Ultimately, the industry isn't just competing against other games anymore; it is fighting a losing battle against our phones.

The 'Mature Market 8' and the Shrinking Global Gamer Pool

The writing is on the wall for what Matthew refers to as the "Mature Market 8." This group, which includes the US, Japan, South Korea, the UK, Germany, France, Canada, and Italy, traditionally drove over 60% of global consumer spending on PC, console, and mobile content before the COVID-19 pandemic. Today, these major regions are facing a severe and persistent reality: they are losing the war for our attention.

In half of these countries, surveys reveal that the number of people who describe themselves as regular gamers is noticeably shrinking, dropping below pre-pandemic levels.

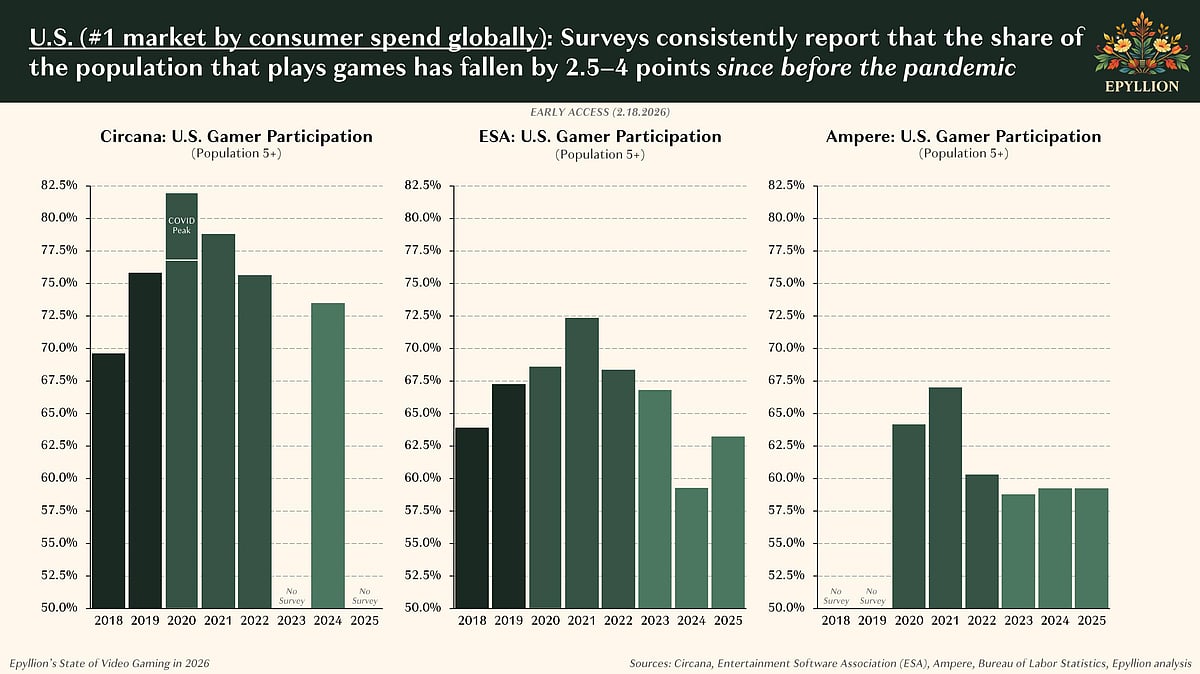

In the United States, data from organizations like Circana, the ESA, Ampere, and the Bureau of Labor Statistics indicates that the share of the population playing games has dropped by 2.5 to 4 percentage points since before the pandemic. An Ipsos survey from January 2026 found that 46 out of every 100 Americans say they play games less than they used to, with that number rising to 59 out of every 100 among those aged 18 to 45.

Even Canada lost roughly one in six of its adult players between 2018 and 2022, even with the temporary boosts of pandemic lockdowns, according to the Canadian trade association's most recent report cited in Ball's data.

Overseas, the declines are just as severe. South Korea has seen a 15 percentage point drop in its gaming participation rate compared to its 2017 to 2019 average, with participation falling even further — down 22 percentage points from its pandemic high. The number of videogame-playing adults in Italy has fallen more than 5 percentage points since 2019, with PC gaming driving the bulk of that decline. Even in the UK, where the player population jumped a massive 21% in 2020, those gains have steadily eroded, with a third of that increase already lost in the years since.

A few countries have managed to buck this downward trend. Since 2016, France has maintained a stable player base with around 52% of its population reporting as gamers. Germany's gaming participation is actually up 4% compared to 2019. Japan stands as the biggest outlier, growing its regular player base by 11% since 2019, though the country's modest and shrinking population means that translates to only about 6 million new players.

However, Matthew stated: even in regions where player numbers have increased, the combined PC and console consumer spending has flatlined or fallen over the last 4 years. Ball's data shows that total PC and console software sales across the Mature Market 8 shrank by 8% from 2021 to 2024, a loss of $4.2 billion per year.

Where Is the Screen Time Going?

So, where is all that screen time going? The decline in gaming aligns with a massive surge in rival entertainment platforms competing for the same hours in the day. Americans now spend 122 million more hours on social media per day than they did in 2020/2021, with TikTok alone accounting for 39 million of those additional daily hours compared to post-COVID normalized levels, according to Ball's data sourced from Emarketer. Meanwhile, US mobile game installs have hit a 12-year low and mobile gaming hours have tumbled.

Consumer spending on platforms like OnlyFans has exploded in that same window. Americans spent roughly $5 billion on OnlyFans in 2025, up from $215 million in 2019 — a more than 23-fold increase. Combined spending on OnlyFans, online sports betting, and iGaming grew from $1.2 billion to $32.8 billion since 2019, a $31.6 billion increase that dwarfs the $12.9 billion increase in video game spending over the same period. Quarterly installations of consumer AI apps have skyrocketed from around 100 million to nearly 1 billion since 2023. Prediction markets, which saw essentially zero activity before 2024, have exploded, with users placing 1.5 million bets a day by Q4 2025. Online sports betting gross gaming revenue has quadrupled from $17.6 billion in 2019 to $69.7 billion in 2025.

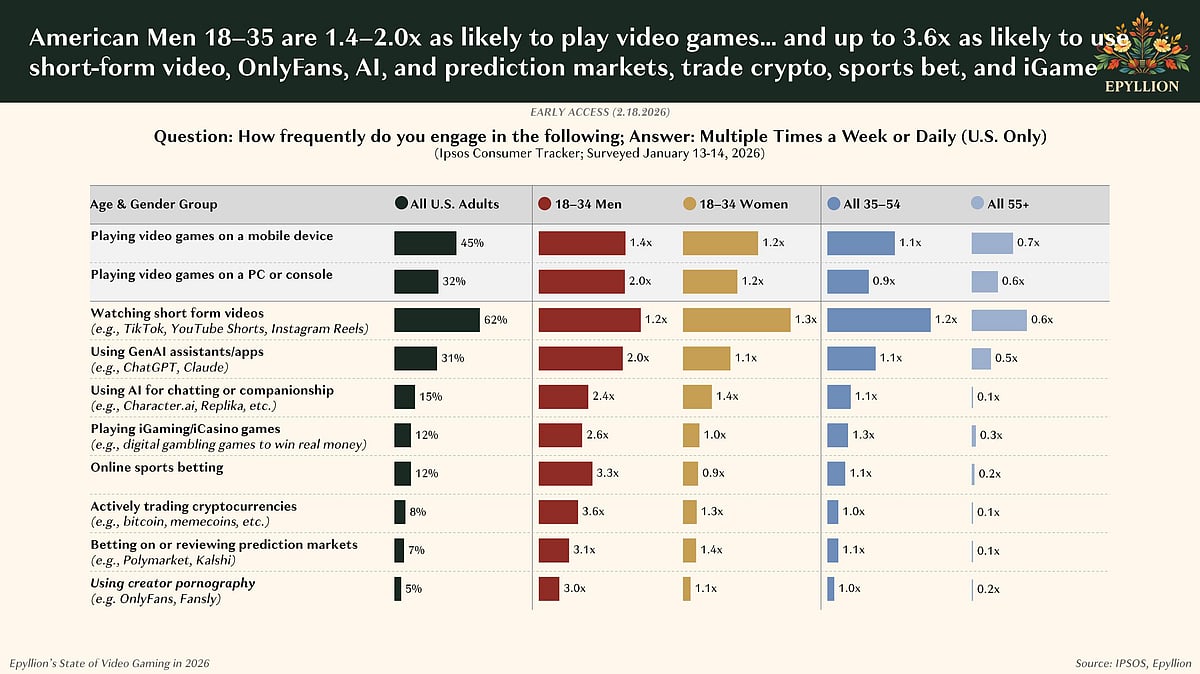

The gaming industry is feeling the burn. According to an Ipsos survey commissioned for Ball's report, American men aged 18 to 34 are 1.4 to 2.0 times as likely as the average adult to play video games, but they are also up to 3.6 times as likely to trade crypto, 3.3 times as likely to sports bet, 3.1 times as likely to use prediction markets, 3.0 times as likely to use OnlyFans, and 2.0 to 2.4 times as likely to use AI tools — making this demographic the epicenter of the attention war.

These rival apps and platforms compete for the same hours and dollars, with gamers facing what Ball describes as a barrage of new, interruptive, and irresistible notifications for these substitutes.

Epyllion's State of Video Gaming in 2026

For the average player, this shrinking audience creates a frustrating, vicious cycle. As the global pool of gamers decreases, the massive revenue demands of modern game development are pushed onto a smaller, more dedicated group. Matthew argues that with fewer new gamers to pull from, growth can only come from greater monetization of ever fewer remaining players.

This pressure feeds into rising prices, increased ads, heavy microtransactions, live-service grinds, and other business strategies aimed at extracting more from those who remain.

The core issue isn't that players choose to watch TikTok instead of buying a AAA game, or subscribe to OnlyFans instead of buying a PlayStation. It's that on a Friday evening, players are placing a growing share of their time and spend elsewhere. Before we even have a chance to pick up a controller, our attention has already been claimed.

Author

Krishna Goswami is a content writer at Outlook India, where she delves into the vibrant worlds of pop culture, gaming, and esports. A graduate of the Indian Institute of Mass Communication (IIMC) with a PG Diploma in English Journalism, she brings a strong journalistic foundation to her work. Her prior newsroom experience equips her to deliver sharp, insightful, and engaging content on the latest trends in the digital world.

Krishna Goswami is a content writer at Outlook India, where she delves into the vibrant worlds of pop culture, gaming, and esports. A graduate of the Indian Institute of Mass Communication (IIMC) with a PG Diploma in English Journalism, she brings a strong journalistic foundation to her work. Her prior newsroom experience equips her to deliver sharp, insightful, and engaging content on the latest trends in the digital world.

Related Articles