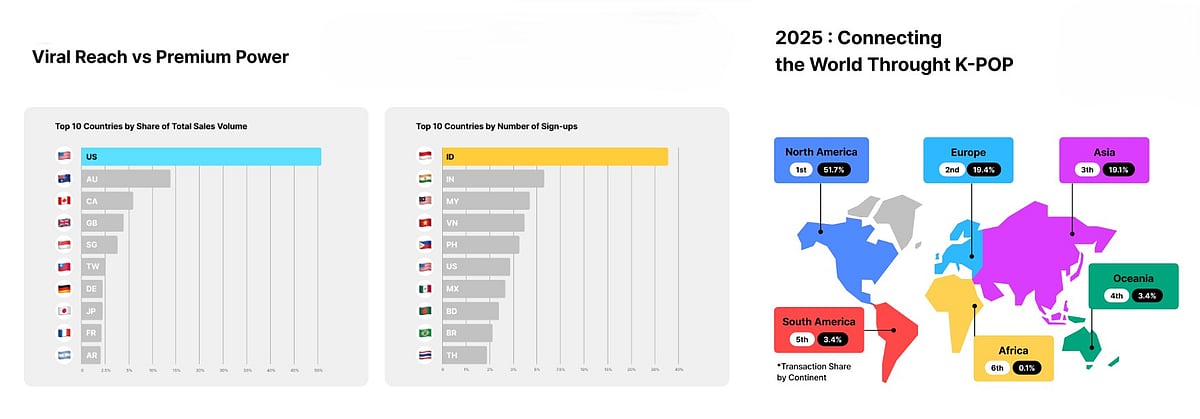

North America accounts for 51.7% of Bunjang’s cross-border commerce with United States taking the top spot.

Bunjang Data Reveals U.S. as the Main Driver of K-pop Merch Sales

The United States accounts for more than half of all cross-border K-pop merchandise sales and resales, indicating a global shift toward digital-era collectibles.

- Bunjang's cross-border K-pop merchandise market is led by the United States, contributing 51.7% of total sales in North America.

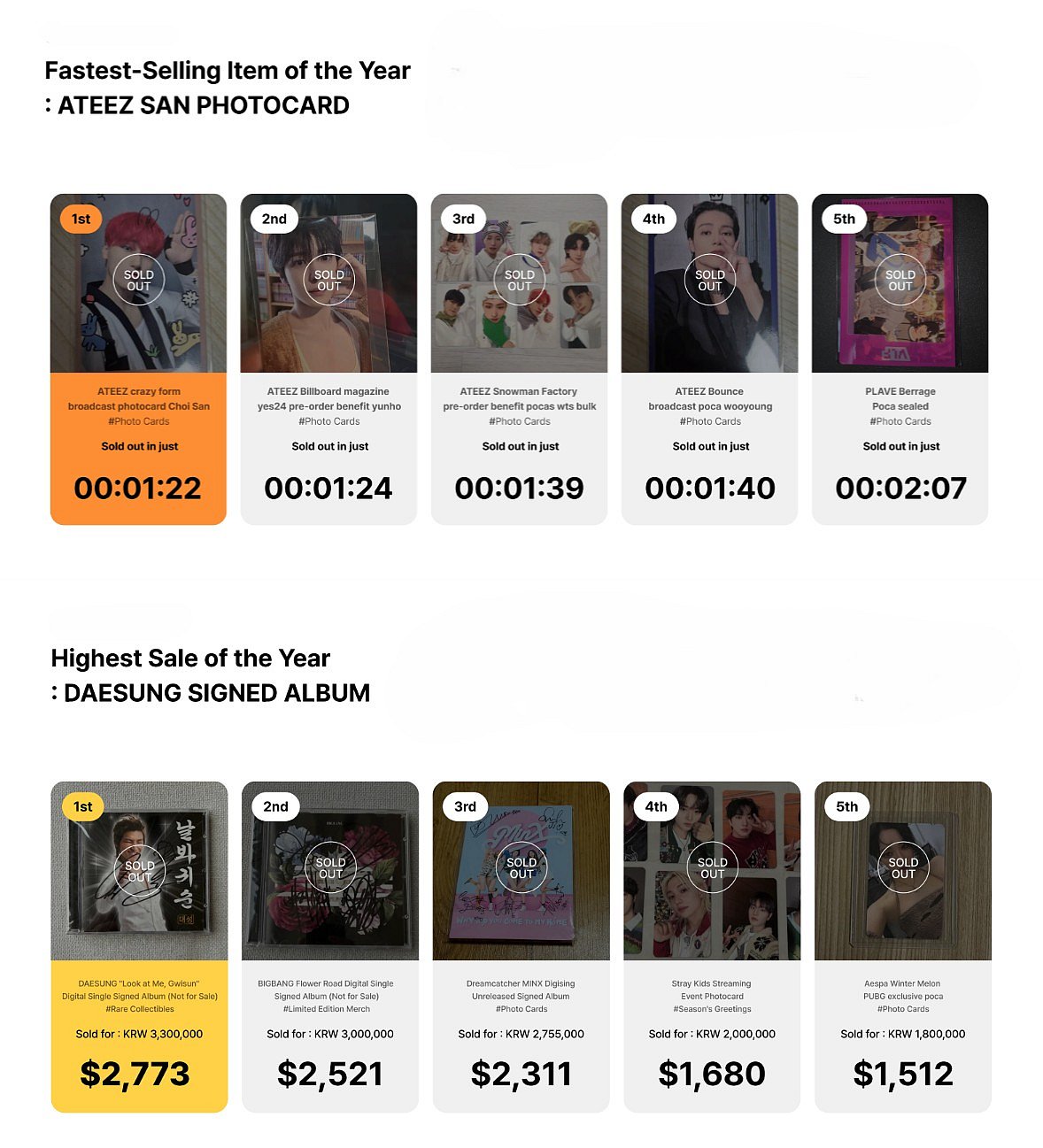

- This desire drives a fast-paced resale industry in which rare photocards sell out in minutes and signed albums hit high prices.

- As a result of this thriving market, Bunjang observed a 729% increase in U.S. users, while also boosting its valuation to $520 million USD.

K-pop has evolved from a music export to a powerful, sophisticated global resale economy, repositioning fan collectibles as a global asset class. This development is being led by the South Korean resale platform Bunjang, which saw tremendous growth through the last year as the United States became its largest overseas market. The pattern, as revealed in its latest 2025 K-POP Trend Report, reflects a fundamental shift in consumer behavior, with K-culture products being seen more as a liquid financial asset than traditional souvenirs.

The report shows that North America accounted for over 51.7% of cross-border commerce on Bunjang's platform, considerably outpacing Europe (19.4%) and Asia (19.1%). This makes the United States the largest single market by sales share, depicting a structural shift from prior Asia-centric trade. As per the report, “The global K-POP market in 2025 is defined by two pillars: Indonesia’s quantitative scale via an overwhelming user base and the United States’ qualitative impact as a powerhouse for physical goods sales.”

2025 BUNJANG K-POP Trend Report

K-pop Merch Like Photocards and Signed Albums Spark U.S. Buying Frenzy

Bunjang, this year, accounted for 34.4 million listings and a supply-side velocity of 65 new uploads per minute. The resale demand for K-pop merch is so high that rare ATEEZ photocards sold out in less than two minutes, while premium items such as signed K-pop records fetched amount like ₩3.3M (~$2,773 USD). Older statistics from 2024 reveal high-priced photocards, such as BTS member Jimin's, reaching ₩3M (~$2,076.51) on secondary markets.

2025 BUNJANG K-POP Trend Report

Sales data demonstrates a substantial variation in what is popular among areas. Stray Kids, for instance, continues to lead global and U.S. marketplaces. On the other hand, NCT dominates in Canadian markets while also surpassing domestic demand in South Korea. These trends further support a broader trend in which photocards are the industry's primary economic indicator, as the most commonly traded category. Photocard sales typically estimate which acts may soon reach total merchandise dominance, reinforcing their overall brand power through item sales.

K-pop Resale Platform Expands Across 200+ Countries

Bunjang has rapidly grown beyond South Korea, owing to the thriving resale industry. Monthly users of the platform increased 729% year on year bolstered by the United States, while also expanding the platform's reach to more than 200 countries. Notably, the number of transactions has increased by more than 200% as Korean goods ship across borders to fulfill global demand.

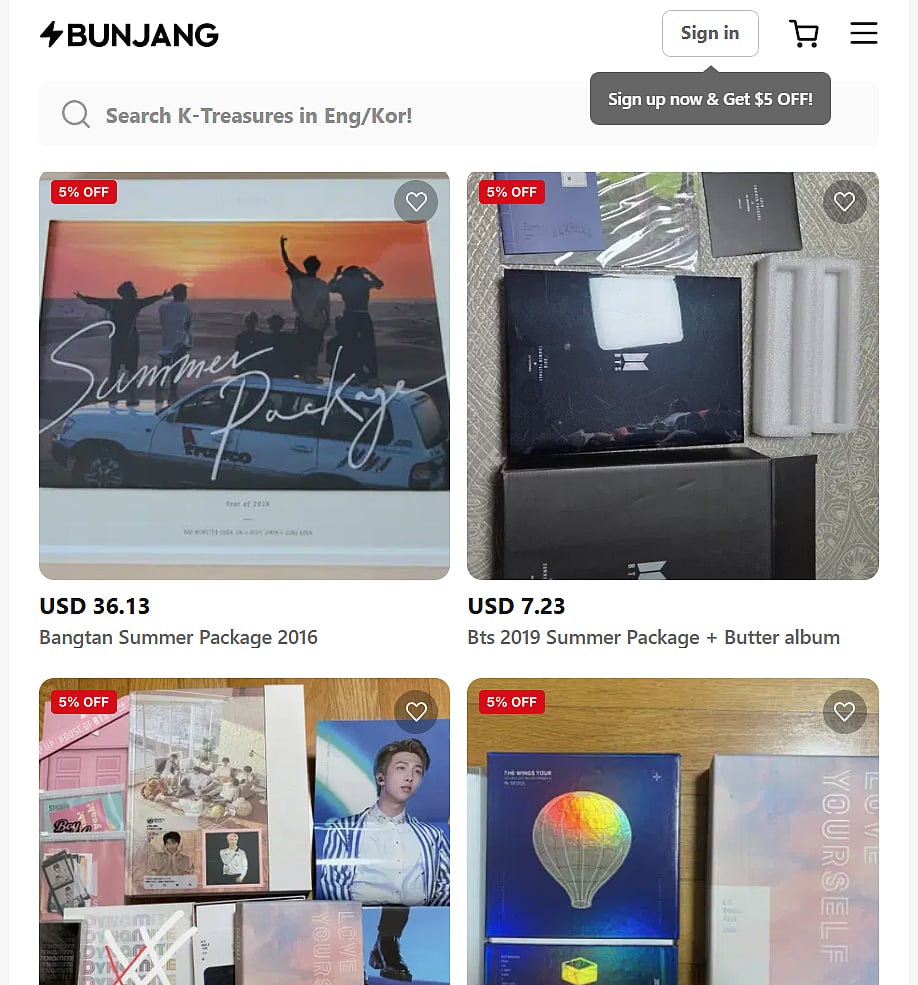

Screen capture: BUNJANG

Korea JoongAng Daily reported that in 2024 alone, Bunjang experienced a 63% growth, with overall trade up by 46%. Interestingly, K-pop products now account for about 70% of all international transactions. This transformation has revolutionized the platform from a domestic marketplace to a critical export channel. With this, Bunjang has incorporated the secondhand resale economy successfully into the global music industry.

Additionally, Korea Economic Daily noted that the platform's commercial success has prompted its owner, Praxis Capital Partners, to initiate a selling process that values the company at around $520M. While large retailers such as Shinsegae Group have been identified as possible buyers, Citi is presently advising on the transaction. This high-profile move indicates an evolution in the broader industry, signaling that K-pop resale is no longer an isolated interest but a big economic driver in the international market.

Author

Diya Mukherjee is a Content Writer at Outlook Respawn with a postgraduate background in media. She has a passion for writing content and is enthusiastic about exploring cultures, literature, global affairs, and pop culture.

Related Articles