Netflix and Paramount battle for Warner Bros.’ valuable anime assets.

Who Will Grab Warner Bros. Anime Portfolio: Netflix or Paramount?

Netflix Eyes Warner Bros. Anime As Industry Experts Highlight Market Monopoly Risks Amid Paramount’s Counterbid.

- Warner Bros. anime portfolio may move to Netflix under the Warner Bros. Discovery sale.

- Paramount Skydance’s $108.4B bid challenges Netflix for control of Warner’s assets.

- Japanese streaming service U-NEXT warns Netflix's dominance could impact local service providers.

Warner Bros. Entertainment is set to transfer nearly 20 years of its anime content to Netflix with the sale of Warner Bros. Discovery, strengthening the streamer's grip on a rapidly expanding worldwide genre. The potential sale highlights the growing strategic relevance of Japanese IP, while heightening industry concerns about who will define anime's distribution and profitability in the future.

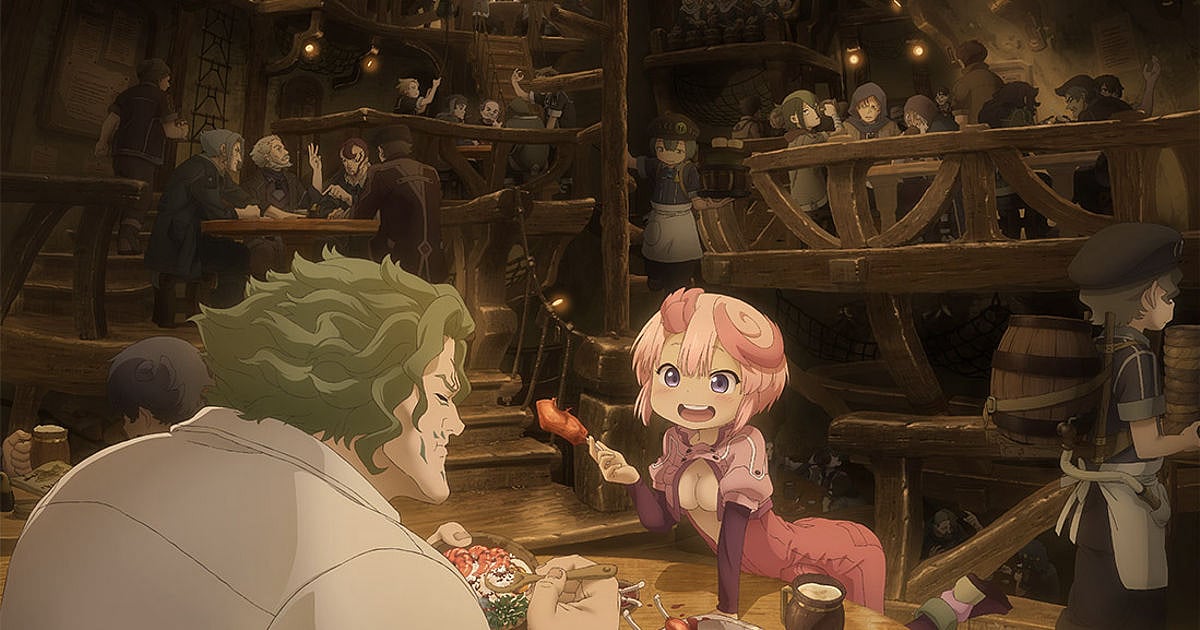

Warner Bros. has developed a strong anime portfolio by production committee investments and collaborations throughout the mid-2000s. The company has backed well-known franchises like JoJo's Bizarre Adventure and Record of Ragnarok. This places Warner Bros. among the top 10 lead investors in recent anime production committees, based on a Comic Market evaluation of titles released between 2022 and 2023.

Netflix-Warner Bros. Deal: Local Market Disruption Amid Content Promotion

Recently, Warner Bros. revealed that it had agreed to sell its studios, as well as HBO and HBO Max, to Netflix for about $72 billion USD in equity, or $82.7B with debt. Nonetheless, Paramount Skydance's aggressive all-cash offer of approximately $108.4 billion has sparked a high-stakes battle for Warner's assets. The move challenges Netflix severely as control over exclusive and niche content, as well as scale, comes more into focus.

Furthermore, Warner Bros. Discovery Japan’s General Manager, Buddy Marini, stated earlier this year that the company wants to increase its output in the coming years, up from its present annual distribution of four to five Japanese titles. This effort is part of the company's objective of promoting local creative content to a larger global audience.

Nevertheless, if Paramount Skydance overtakes Netflix in the Warner Bros. deal, it would be the first of its kind. This would mean a non-anime legacy player may soon become a top producer and distributor of anime content.

Netflix's potential acquisition of Warner Bros. Discovery, along with HBO Max titles, has raised concerns among Japanese streaming services like U-NEXT, which already distributes HBO Max content. U-NEXT CEO Yasuhide Uno highlighted in a Kyodo News statement that foreign firms being too dominant could cause a market disruption as well as affect the broadcasting and film industries. Yasuhide cited Netflix's monopoly in South Korea as an example, indicating that such dominance could restrict consumer choice and damage domestic content services.

Regardless of the winning bidder, the destiny of Warner Bros.' anime collection will mark a watershed moment in the global anime industry. A Netflix triumph would further consolidate control around a single global distributor, but a Paramount success would represent a rare shift of anime to Hollywood. Either way, it highlights a larger reality that anime is no longer just a specialized area, but rather is turning into a strategic global asset. Anime IPs are now at the heart of a high-profile war for cultural impact, distribution control, and the future economics of global streaming.

Author

Diya Mukherjee is a Content Writer at Outlook Respawn with a postgraduate background in media. She has a passion for writing content and is enthusiastic about exploring cultures, literature, global affairs, and pop culture.

Related Articles