Highlights

- 3D Investment Partners increased its stake in Square Enix to 16.48%, following multiple share purchases in December 2025.

- The fund is now Square Enix’s second-largest shareholder, trailing founder Yasuhiro Fukushima’s 19.28% holding.

- The higher stake strengthens 3D Investment Partners’ ability to press management and strategic changes at the publisher.

Square Enix shareholder 3D Investment Partners has increased its Square Enix stake in the publisher to 16.48%, strengthening its position as pressure builds on the company’s management. The increase was highlighted by Kantan Games analyst Serkan Toto, who noted that the fund made multiple share purchases in December 2025, lifting its holding from a previously disclosed 15.40%.

Singapore-based 3D Investment Partners is now the second-largest shareholder in Square Enix, trailing only Enix founder Yasuhiro Fukushima, who holds 19.28% of the company. At the current pace of accumulation, the fund could overtake Fukushima, potentially reshaping Square Enix’s shareholder structure.

3D Investment Partners Builds Leverage to Push Strategy Changes

The larger stake strengthens 3D Investment Partners’ ability to advance its management proposals. The fund first invested in Square Enix in April 2025, acquiring a 5.47% stake and stating that its objective extended beyond pure investment to advising management and making proposals depending on circumstances.

That initial position was disclosed to Japan’s Kanto Local Finance Bureau. According to a machine-translated Reuters report citing the filing, 3D Investment Partners said the holding was for investment purposes and that it may provide advice and submit proposals to management depending on the situation.

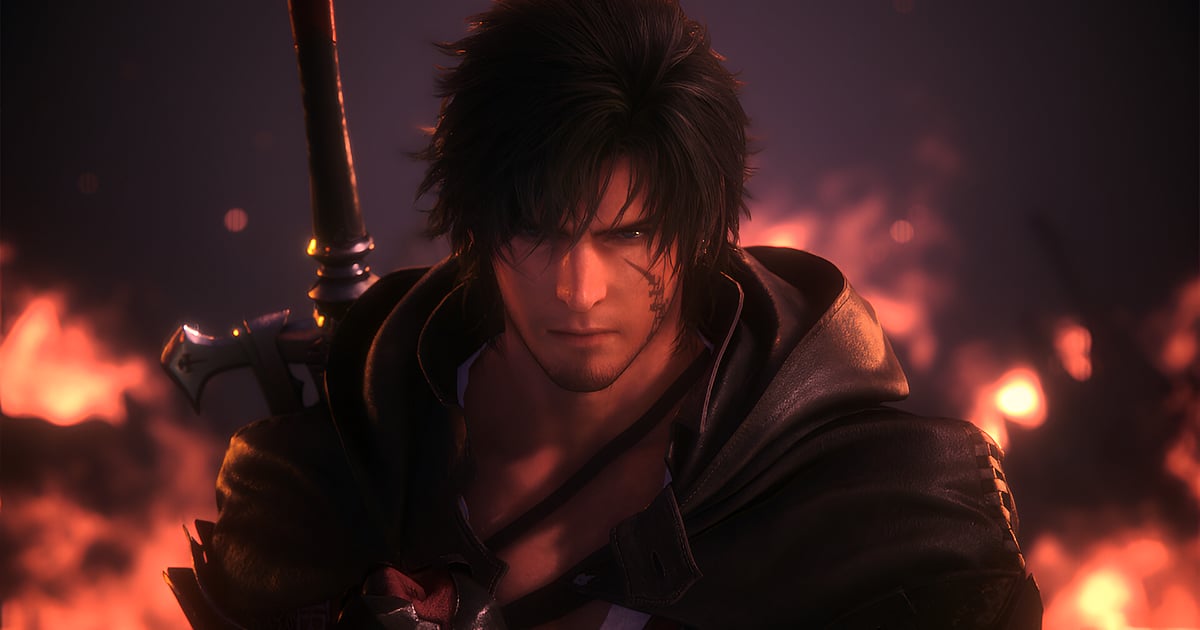

Earlier in December 2025, the fund published a 112-page presentation criticizing Square Enix’s business strategy and calling for management-level changes. Square Enix has not publicly responded.

The growing stake highlights the expanding role of shareholder-led pressure in Japan’s games industry, and signals continued governance scrutiny for one of the sector’s most established publishers.