Top 10 Gaming Companies Controlling the $178B Video Game Industry

Top 10 Gaming Companies Controlling the $178B Video Game Industry

Highlights

- Console giants compete using subscriptions, exclusive hardware, and beloved IP.

- Tencent dominates globally via investments, while Valve controls the PC market via Steam.

- Modern publishers prioritize ongoing revenue from live services, esports, and creator economies.

The global video game industry has evolved from a niche hobby into a cultural and economic powerhouse that rivals Hollywood in scope and influence. With the gaming market reaching $188.9 billion in 2025, according to Newzoo's Global Games Market Report, this digital entertainment sector has become one of the world's fastest-growing industries.

The esports market, valued at $1.86 billion in 2025, represents a rapidly expanding segment that has transformed competitive gaming into a spectator sport filling arenas worldwide. But understanding the modern gaming landscape means understanding the companies that dominate it—the gaming industry giants whose strategic decisions shape how millions of players experience interactive entertainment.

From console manufacturers like Sony PlayStation and Nintendo Switch to gaming software companies like Electronic Arts and Epic Games, these top gaming companies don't just create entertainment. They architect entire ecosystems where we play, compete, and spend our money. Their influence extends far beyond game development, determining which platforms succeed, how we access games, and what the future of gaming looks like.

1. Microsoft Gaming: Xbox Game Pass and the Subscription Revolution

Microsoft Gaming, under the leadership of CEO Phil Spencer, has fundamentally transformed from a console-focused company into a gaming services powerhouse. No longer focused primarily on winning the traditional "console war," Microsoft has evolved into a content behemoth built on three pillars: Xbox Game Studios (home to franchises like Halo), ZeniMax Media (publisher of Fallout and The Elder Scrolls), and the recently acquired Activision Blizzard King empire (Call of Duty, World of Warcraft, Candy Crush).

The company's entire strategy now revolves around Xbox Game Pass, their "Netflix for games" subscription service that has attracted approximately 34 million subscribers as of early 2025. The massive acquisitions, including the $68.7 billion purchase of Activision Blizzard, were not about eliminating competition but about securing "must-have" content to fuel this subscription model. This pivot has driven substantial growth in Microsoft's gaming segment following the Activision deal, validating their bet on the subscription future of gaming.

2. Sony Interactive Entertainment: PlayStation 5 and Exclusive Gaming Content

Sony Interactive Entertainment has built its empire around a simple strategy: create exceptional, exclusive games that can only be experienced on PlayStation hardware. This approach focuses on high-budget, critically acclaimed titles developed by world-class studios like Naughty Dog, Santa Monica Studio, and Insomniac Games, resulting in must-play experiences like God of War, Marvel's Spider-Man, and The Last of Us.

Sony

With over 56 million PlayStation 5 consoles sold as of mid-2025, this strategy continues to prove successful. Gaming consistently represents Sony's largest and most profitable division, generating record-breaking quarterly revenues approaching $10 billion during peak periods.

3. Nintendo: Switch Console Innovation and Family Gaming

Nintendo operates in its own unique ecosystem, deliberately avoiding direct competition with Sony and Microsoft on technical specifications. Instead, they compete on innovation and fun, a strategy that led the original Nintendo Switch to sell an extraordinary 140 million units. This approach continues with their successor, the Nintendo Switch 2, launched on June 5, 2025, becoming the fastest selling console ever.

Nintendo’s strategy relies on leveraging its untouchable intellectual properties like Mario, Zelda, and Pokémon to drive these hardware sales, making it one of Japan's wealthiest entertainment companies.

Nintendo's approach to esports reflects its brand philosophy: they remain cautious and protective, preferring to support grassroots tournaments for games like Super Smash Bros. rather than investing heavily in high-stakes professional leagues. The successful launch of the Switch 2, which features upgraded hardware like 4K docked support and new controllers, has solidified Nintendo’s market position and support from major third-party publishers.

4. Tencent Games: The Global Gaming Investment Giant

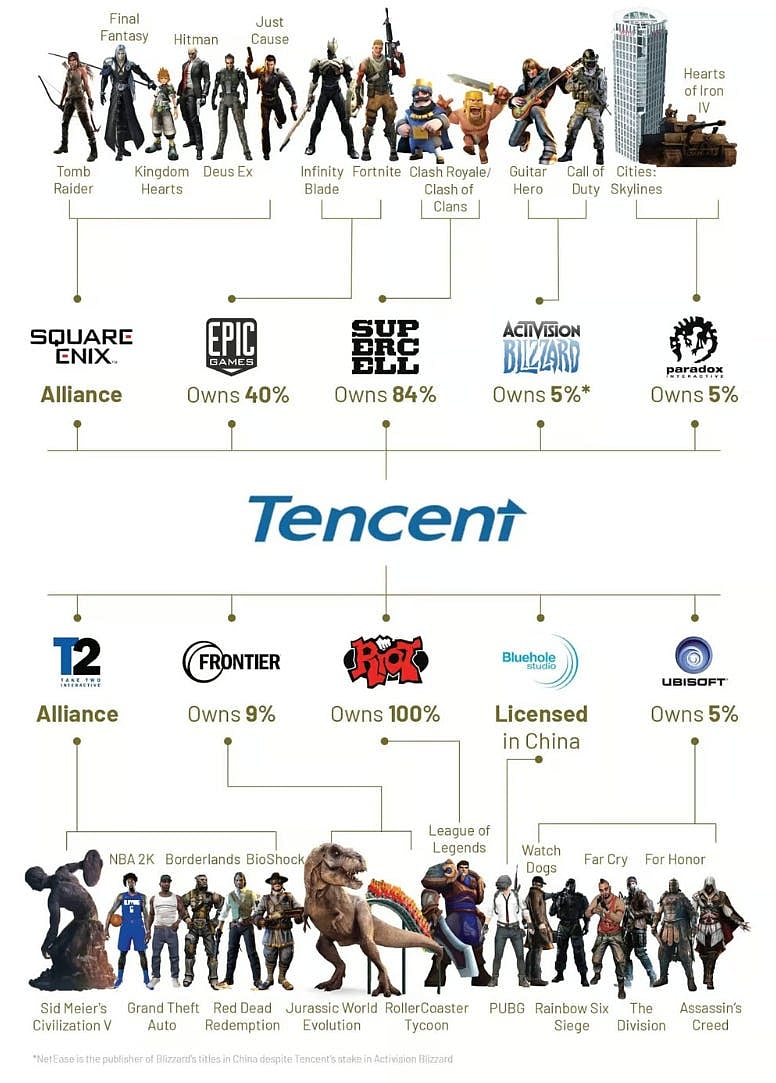

Tencent represents gaming's ultimate investment empire and the world's largest gaming company by revenue. This Chinese technology conglomerate's portfolio reads like a who's who of gaming: 100% ownership of Riot Games, a 40% stake in Epic Games, and significant investments in companies ranging from Ubisoft to FromSoftware.

Coughlincapital

While their Western investments capture headlines, Tencent's internal studios dominate the mobile gaming market with titles like Honor of Kings and PUBG Mobile. This comprehensive strategy generated $27 billion in gaming revenue in 2024, according to Niko Partners. They've also pioneered mobile esports through franchised leagues like the King Pro League, demonstrating how competitive gaming can thrive on smartphones in markets where console gaming never established dominance.

5. Valve Corporation: Steam Platform and PC Gaming Dominance

Valve Corporation operates as gaming's most enigmatic empire and the undisputed king of PC gaming. Under the leadership of legendary founder Gabe Newell, this privately held company has maintained an almost mystical status in the gaming industry. Their superpower lies precisely in what they're not—they're not beholden to quarterly earnings reports or shareholder demands, allowing them to pursue long-term strategies that public companies often cannot afford.

Valve's dominance stems from Steam, the digital storefront that has become synonymous with PC gaming itself. Steam's industry-standard 30% revenue cut functions as a financial engine that funds everything from acclaimed games like Dota 2 and Counter-Strike to ambitious hardware experiments like the Steam Deck.

Their approach to esports reflects their unconventional philosophy: rather than operating traditional leagues, they operate them through third-party tournament organizers. The company in the past, also allowed the community to crowdfund prize pools for The International, Dota 2's world championship, which reached a staggering $40 million at its peak.

6. Epic Games: Fortnite Success and Gaming Industry Innovation

Epic Games, led by founder and CEO Tim Sweeney, has positioned itself as the gaming industry's most aggressive challenger to established norms. Backed by heavyweight investors including Chinese tech giant Tencent and entertainment powerhouse Disney, Epic's influence stems from two primary sources: Fortnite, the cultural phenomenon that has become their personal money-printing machine, and Unreal Engine, the sophisticated technology that powers countless games across the industry.

Sweeney has leveraged this financial strength to wage an unprecedented war against what he terms the 30% "platform tax" that digital storefronts traditionally charge developers. His primary weapon is the Epic Games Store, which takes only a 12% cut from game sales. The store currently operates at a loss, subsidized entirely by Fortnite's massive profits, but this sacrifice is intentional, it's a long-term investment in reshaping industry economics. This philosophy has also driven Epic's high-profile legal battles against Apple and Google over their app store policies, cases that have reverberated throughout the tech industry.

7. Riot Games: League of Legends and Professional Esports Innovation

Riot Games stands as the architect of modern competitive gaming and esports entertainment. Though entirely owned by Chinese conglomerate Tencent, Riot operates with considerable autonomy, functioning as its own kingdom within the larger empire. Their foundation was built on League of Legends, which didn't just succeed as a game, it perfected the free-to-play business model by monetizing cosmetic items and character skins rather than gameplay advantages.

Riot's most significant contribution to the gaming industry was the invention of the modern professional esports league. They approached competitive gaming with the seriousness of traditional sports, creating franchised leagues like the League Championship Series (LCS) and charging over $10 million for team slots. This model attracted investors from the NBA and other traditional sports, legitimizing esports in ways previously unimaginable.

They've successfully replicated this formula with their tactical shooter Valorant and its professional circuit, the Valorant Champions Tour. Their influence has extended beyond gaming through projects like Netflix’s Arcane, the animated series that proved their intellectual property could compete in mainstream entertainment.

8. Electronic Arts (EA): Sports Gaming and Live Service Models

Electronic Arts (EA) represents one of the gaming industry's most successful transformations from traditional game sales to ongoing service relationships. Their business model focuses on generating continuous revenue from established franchises, with "Ultimate Team"—the card-collecting mode found in EA SPORTS FC and Madden NFL—serving as their primary cash cow. This single gameplay mode generates billions of dollars annually and effectively funds the entire corporation's operations.

Beyond sports gaming, EA owns the successful battle royale title Apex Legends and the life-simulation franchise The Sims. The company generated approximately $7.8 billion in revenue in 2024, according to recent SEC filings. While they operate professional esports leagues like the Apex Legends Global Series, EA frequently faces criticism from players who view their monetization tactics as overly aggressive or "pay-to-win."

9. Roblox Corporation: User-Generated Content and Creator Economy

Roblox Corporation, led by CEO David Baszucki, has created something entirely different from traditional gaming companies. Roblox isn't a game—it's a massive global platform enabling millions of user-generated gaming experiences. Their business model centers on a creator economy powered by Robux, their virtual currency that allows users to monetize their creations.

This approach has proven wildly successful, particularly among younger demographics, driving $3.6 billion in revenue in 2024. Unlike traditional gaming companies that control content creation, Roblox provides tools and infrastructure while users create and monetize their own experiences. However, this open platform model creates significant challenges around content moderation and child safety, issues that continue to define much of the company's ongoing development efforts.

10. Savvy Games Group: Saudi Arabia's Gaming Investment Powerhouse

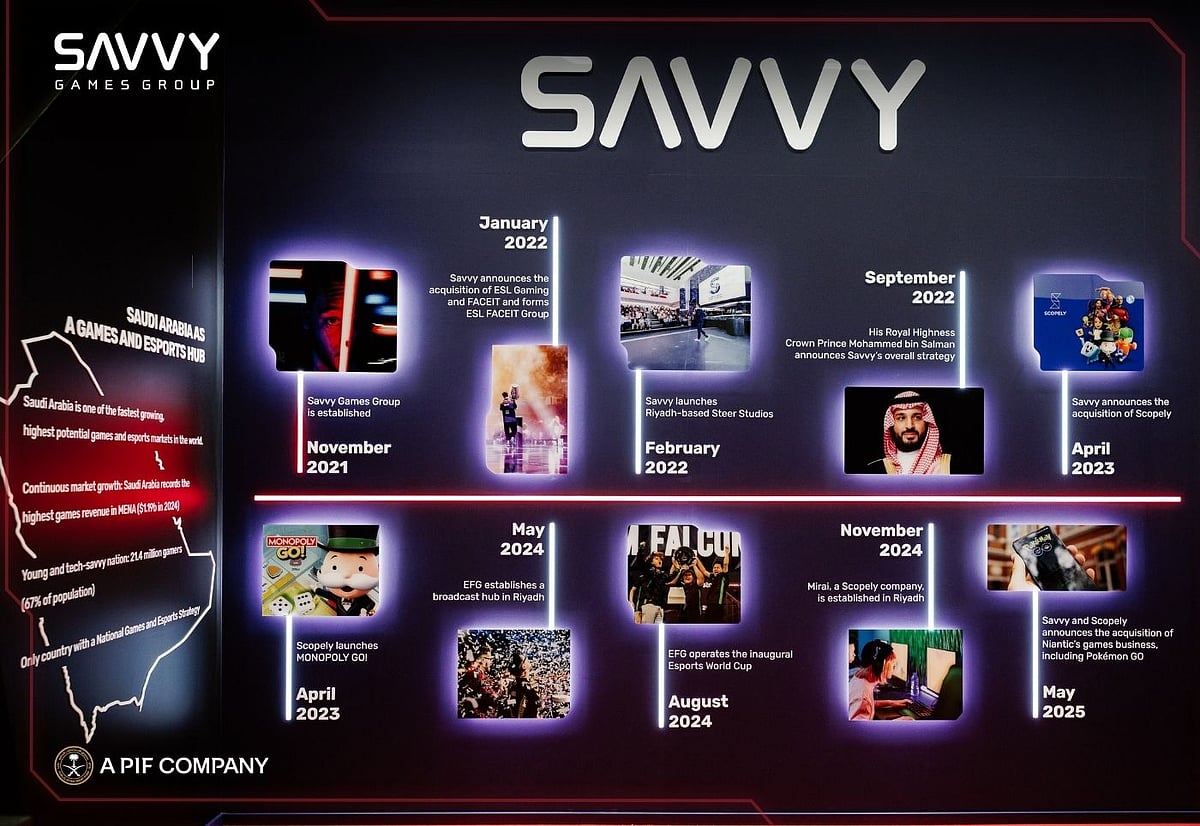

Savvy Games Group represents the newest but most ambitious player in the global gaming ecosystem. Established in 2021 by Saudi Arabia's Public Investment Fund (PIF), this Riyadh-based company has rapidly emerged as a formidable force through aggressive acquisitions and strategic investments totaling over $10 billion since its founding.

Under CEO Brian Ward's leadership, Savvy operates through a multi-pronged strategy focused on game development and publishing, esports, and ecosystem development. The group's crown jewel is Scopely, acquired for $4.9 billion in 2023, which achieved phenomenal success with MONOPOLY GO! surpassing $3 billion in revenue and earning recognition as one of TIME Magazine's "100 Most Influential Companies" in 2024.

Savvy Games Group

Savvy's esports division, ESL FACEIT Group, made history by operating the inaugural Esports World Cup in Riyadh, setting new viewership records and establishing Saudi Arabia as a major esports destination. The group's strategic investments include minority stakes in gaming giants Nintendo, Capcom, EA, and Embracer Group, positioning it as a significant stakeholder across multiple gaming sectors.

Perhaps most significantly, Savvy completed a $3.5 billion acquisition of Niantic's games business in May 2025 through Scopely, bringing iconic titles like Pokémon GO, Pikmin Bloom, and Monster Hunter Now into its portfolio. This move dramatically expanded Savvy's presence in location-based and augmented reality gaming.

Currently the 8th largest games publisher by net revenue, Savvy aims to become the world's number one games and esports company while transforming Saudi Arabia into a global gaming hub by 2030. Their ambitious targets include establishing 250 gaming companies, creating 39,000 jobs, and contributing SAR 50 billion to GDP from the gaming sector as part of Saudi Arabia's Vision 2030.

The Future of the Gaming Industry: Ecosystem Competition and Market Trends

The modern video game industry has evolved into a battle of competing ecosystems rather than individual products. Microsoft pursues comprehensive consolidation to fuel Xbox Game Pass subscriptions, while Sony builds a fortress of exclusive content to protect PlayStation hardware sales. Meanwhile, the most financially successful model may belong to companies like Riot Games and Electronic Arts, who have perfected the live-service gaming approach that generates continuous revenue from engaged player bases.

These top gaming companies are no longer merely competing for our leisure time—they're fighting to control the infrastructure of digital entertainment itself. As gaming continues its transformation from hobby to primary entertainment medium, the strategic decisions made in boardrooms from Bellevue to Beijing will determine how we play, compete, and connect in virtual worlds.

The stakes extend far beyond quarterly earnings reports. These corporate titans are architecting the future of interactive entertainment, and their strategies today will shape the digital playgrounds of tomorrow. In this high-stakes game, the ultimate prize isn't just market share—it's the power to define how humanity experiences play in the digital age.

Author

Krishna Goswami is a content writer at Outlook India, where she delves into the vibrant worlds of pop culture, gaming, and esports. A graduate of the Indian Institute of Mass Communication (IIMC) with a PG Diploma in English Journalism, she brings a strong journalistic foundation to her work. Her prior newsroom experience equips her to deliver sharp, insightful, and engaging content on the latest trends in the digital world.

Krishna Goswami is a content writer at Outlook India, where she delves into the vibrant worlds of pop culture, gaming, and esports. A graduate of the Indian Institute of Mass Communication (IIMC) with a PG Diploma in English Journalism, she brings a strong journalistic foundation to her work. Her prior newsroom experience equips her to deliver sharp, insightful, and engaging content on the latest trends in the digital world.

Related Articles