Game Content Market Grows to $195.6B in 2025 Despite Funding Drop

Game Content Market Grows to $195.6B in 2025 Despite Funding Drop

Video game industry revenue hits record levels, outsourcing rises, and platform spending reshapes growth.

Highlights

- Global game content revenue rose 5.3% to $195.6B in 2025 as private funding declined 55%.

- Outsourcing hit 35.5% of content investment, with core creative work increasingly externalized.

- Roblox drove 67% of market growth as subscriptions and China spending reshaped demand.

Global video game content revenue climbed to $195.6 billion USD in 2025, marking a 5.3% annual increase. Private financing, however, contracted 55%, according to Epyllion’s State of Video Gaming 2026 report, led by CEO, Matthew Ball. The industry extended its growth streak to three years and set a new earnings peak despite tightening capital flows.

Production economics continued to shift toward external partners. Outsourcing represented 35.5% of total content investment last year, rising from 30.6% in 2017 and 31.5% during the pandemic period.

The report described an “increasing reliance on outside partners for core creative work,” with 60% to 95% of animation, audio, and environmental design executed externally. “Flexible skillset” ranked as the leading adoption factor.

Credit allocations reflected this structure, including Hollow Knight: Silksong, which listed three internal contributors versus 94 external. Palworld followed a similar pattern, recording 97 internal and 93 external credits, including 80 tied to Keywords Studios.

Platform Services, PC Expansion, and China Shape Global Game Content Sales

Console content spending reached $41.6B, only 2.3% above 2020 levels. Subscription platforms such as PlayStation Plus, Xbox Game Pass, and Nintendo Switch Online accounted for 119% of net growth.

However, direct console software spending declined nearly 11% year-on-year (YoY). PC spending expanded 30% since 2020, reaching $40.7B.

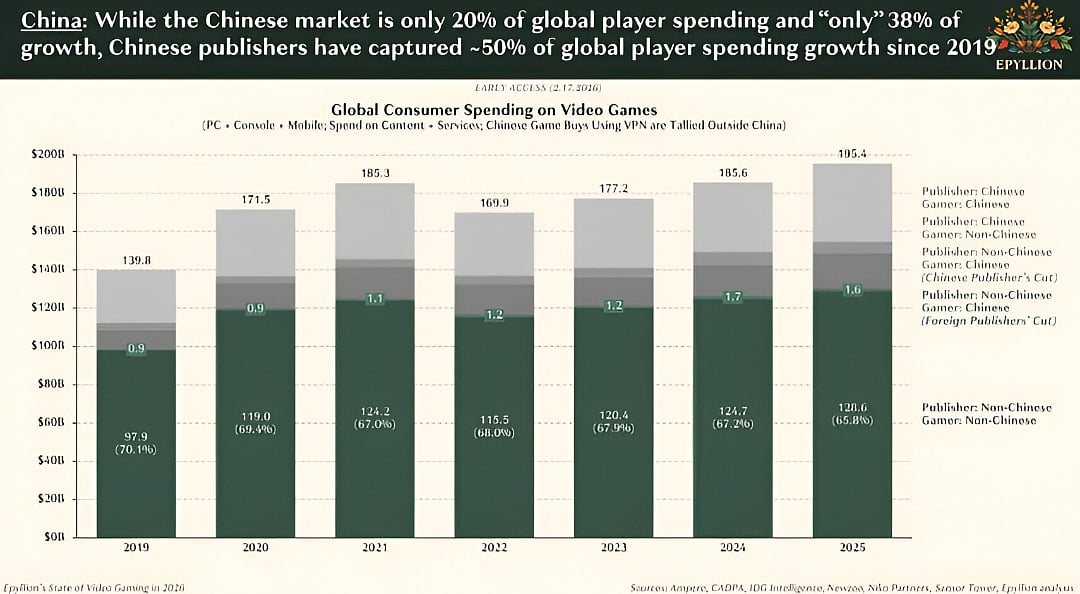

Meanwhile, China accounted for 20% of worldwide player spending.

Ball stated that matching global growth requires winning China, “or grow(ing) 1.6 times the market elsewhere.” Chinese publishers have driven roughly half of the global spending expansion since 2019.

Investment activity slowed late in the year, with 40 fourth-quarter (Q4) deals, including under $100M in pre-seed and over $200M in early-stage funding. Layoffs totaled around 9.2K in 2025, bringing the four-year figure near 44K. Almost half of the redundancies occurred in California between 2022 and 2025.

Epyllion

Likewise, Roblox generated 67% of net market growth, having surpassed major consoles in daily active users (DAU) by the end of 2024. Its user base rose by another 69% in 2025, with monthly engagement exceeding 10B hours.

Growth vectors for 2026 include external development, non-core markets, advertising, direct payments, and Roblox.

The report highlights an industry growing in revenue while reshaping funding, production, and monetization models. These shifts will influence investment, platforms, and development strategies in 2026.

Author

Probaho Santra is a content writer at Outlook India with a master’s degree in journalism. Outside work, he enjoys photography, exploring new tech trends, and staying connected with the esports world.

Related Articles