Highlights

- Gaming M&A reached a record $161B in 2025, driven by EA’s $55B buyout and Netflix’s $82.7B Warner Bros. acquisition.

- Consolidation extended beyond mega deals, including Netflix’s Ready Player Me buy and Scopely’s $3.5B Niantic deal.

- Mobile and AI-led financing trends, with investment activity rebounding in the second half of the year.

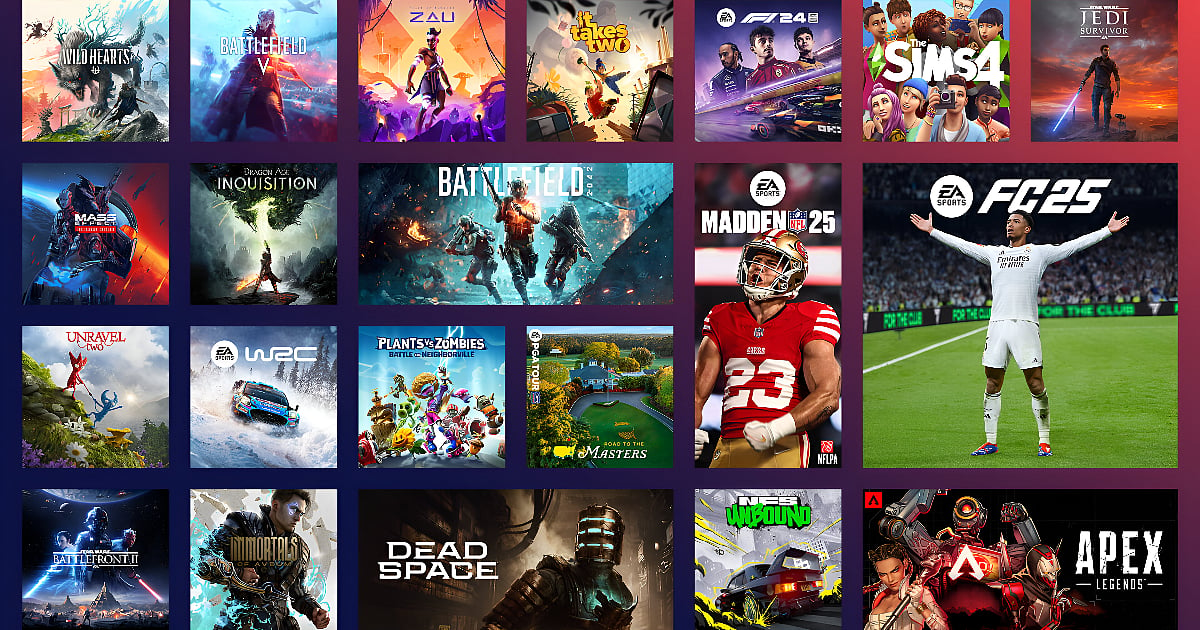

The gaming industry M&A (mergers & acquisitions) reached a record $161 billion USD in disclosed deal value in 2025, driven by two transactions that dominated the year: Electronic Arts’ $55B leveraged buyout and Netflix’s $82.7B announced acquisition of Warner Bros., including Warner Bros. Games. The figures were published in the Drake Star Global Gaming Report 2025, which described the period as a “landmark year for gaming M&A.”

Those two mega deals accounted for the majority of disclosed value and underscored how gaming assets have become central to broader media, technology, and platform strategies. The report also pointed to rising competitive pressure across entertainment, highlighted by Paramount-Skydance’s hostile $108.4B bid for Warner Bros. Discovery during the year.

Beyond the headline transactions, Netflix continued to build out its games and technology strategy in Q4 2025 with the acquisition of avatar technology company Ready Player Me.

Other significant strategic moves included Scopely’s $3.5B acquisition of Niantic’s games business and Tripledot Studios’ $800M purchase of AppLovin’s gaming division, both ranking among the largest non-mega deals of the year.

Gaming Industry M&A 2025 Outlook and Financing Trends

Private financing activity in 2025 was led by mobile and AI (artificial intelligence)-focused companies. Major mobile deals included CVC and Blackstone’s $2.5B investment in Dream Games, alongside funding rounds for Lingokids ($120M), Good Job Games ($60M), and Million Victories ($40M).

On the AI side, companies building AI world models and creative technologies raised large rounds, reflecting growing interest in tools that could influence how games are made.

Overall financing activity bottomed out in Q2 2025 with 105 rounds, before rebounding in the second half of the year, rising to 118 rounds in Q3 and 137 rounds in Q4.

The most active investors included Play Ventures, Bitkraft, and Griffin Gaming Partners, while Impact46, Merak Capital, and TIRTA led seed-stage investment activity.

Looking ahead, the report says there is a “very positive outlook” for gaming and tech M&A in 2026, with private equity expected to remain a major driver as publicly listed gaming companies are increasingly viewed as take-private targets. The primary investment areas driving the next wave of industry consolidation are expected to continue to be AI, UGC (user-generated content), specialized tools, and technology platforms.