Mobile Games Revenue Growth Slowed to 0.2% in 2025

Mobile Games Revenue Growth Slowed to 0.2% in 2025

Generative AI apps and D2C payments redefine mobile market dynamics.

Highlights

- Mobile games revenue growth slowed to 0.2% YoY in 2025; downloads rose 4.6%.

- D2C revenue grew 26% across the Americas.

- Apps overtook games in IAP revenue as Gen-AI and AI ads surged.

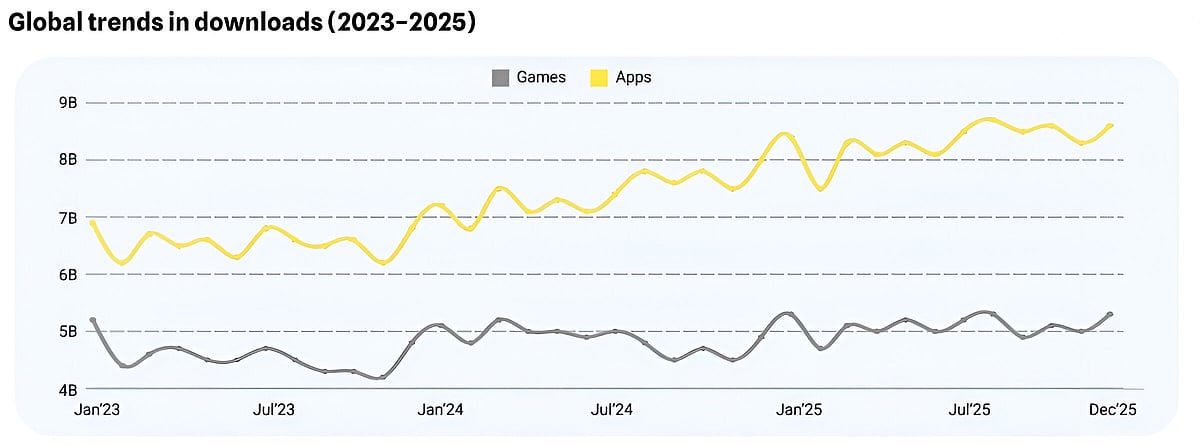

Global mobile games revenue growth slowed to 0.2% year-on-year (YoY) in 2025, down from 3% in 2024, according to AppMagic’s ‘Mobile Market Landscape 2026’ report released Feb 5, 2026. Download growth also decelerated to 4.6%, pointing to rising market saturation trends. The report outlines shifts in genre performance, monetization strategy, and competitive pressure across the mobile sector.

Strategy ranked as the fastest-growing major genre, with revenue rising 16% and downloads up 15%. At the same time, direct-to-consumer (D2C) monetization gained momentum as top-grossing titles expanded payments beyond app stores.

According to the report, D2C and alternative payment revenue grew 26% year-on-year across games in the Americas, while the top 100 titles increased D2C earnings by 38%.

Artificial intelligence (AI) has also become embedded in marketing production. In 2025, 56 of the top 100 grossing mobile games used AI-generated ad creatives, reflecting mainstream adoption of automated creative tools.

Apps Overtake Games IAP Revenue as Generative AI Drives Mobile Market Growth

Non-gaming apps earned more in in-app purchase (IAP) revenue than games for the first time in September 2025. Non-gaming apps generated $4.8B in revenue, while games generated $4.5B in the same month. Growth was led by platforms including ChatGPT, TikTok, and HBO Max.

Across the year, non-gaming downloads rose 11.9%, while revenue increased 19.1%. This growth was supported by generative AI (gen-AI) apps, which recorded 178% download growth and 273% revenue growth.

Games increased their share of new releases from 63% in 2024 to 72% in 2025. Total app launches climbed 25% year-on-year to more than 1.4M, though only about 10% captured meaningful user attention, highlighting intensifying discoverability challenges.

Regionally, Latin America showed signs of saturation, with downloads stalling or declining across Peru, Ecuador, Colombia, and Argentina.

AppMagic

AppMagic noted the report analyzes trends that have emerged over the past several years and are expected to continue shaping the market in 2026. It spans gaming segments, including casual, midcore, and hypercasual, alongside app categories such as gen-AI, entertainment, social, and tools.

Author

Probaho Santra is a content writer at Outlook India with a master’s degree in journalism. Outside work, he enjoys photography, exploring new tech trends, and staying connected with the esports world.

Related Articles