Highlights

- Scara Gaming is targeting India’s 500 million casual gamers, not just the esports audience.

- Microtransactions and volume economics, not high average revenue per user (ARPU), define India’s monetization strategy.

- India’s gaming industry is one proof-of-concept brand campaign away from mainstream advertising adoption.

India’s gaming industry still frames itself through esports headlines. Prize pools, monthly active users (MAU), franchise teams, and broadcast deals dominate the narrative. One of the professionals who helped build parts of that ecosystem now believes the industry may be over-indexing on the wrong signal.

Manoj George, a senior gaming executive who previously led business operations at some of India’s largest esports and gaming companies, founded Scara Gaming with a different thesis. Competitive gaming commands attention, he argues, but the country’s real scale lies in its casual base. Hundreds of millions of Indians play daily without identifying as “gamers,” and they represent a commercially underleveraged audience.

In conversation with Outlook Respawn, George explains why brands still misread gaming economics, why publisher-led esports models face structural friction, and why tier-two and tier-three markets may define the next phase of growth. The discussion moves beyond personality and into strategy, positioning Scara Gaming less as a content venture and more as a long-term market bet.

Scara Gaming’s Founding Thesis: 500 Million Casuals, Not Just Esports

When asked what market gap led to Scara Gaming’s formation, George avoided singling out competitors. Instead, he described a structural blind spot across the ecosystem.

George said that most stakeholders were approaching gaming purely through an esports lens, building intellectual properties (IP) around Battlegrounds Mobile India (BGMI) or Free Fire while overlooking the much larger cohort of casual participants. He explained that in India, gamers are often stereotyped as full-time competitive players, when in reality the majority are casual participants who integrate gaming into everyday routines.

George said, “The larger chunk are casual gamers. They not only follow gaming, but they also follow pop culture. The person playing could be waiting for a cab, waiting for a meeting to start, or unwinding at the end of the day with friends. That is how they engage. It is more community than esports.”

From a commercial standpoint, he believes this audience represents the real opportunity. George explained that there are roughly 500M casual gamers in India. These include players of Candy Crush, Ludo King, Subway Surfers, Clash of Clans, and 8 Ball Pool, alongside those who occasionally log into Valorant or PlayerUnknown’s Battlegrounds (PUBG) with friends.

He added that this demographic spends meaningful time gaming, roughly 13 hours a week, and demonstrates an appetite for in-game purchases when pricing aligns with local expectations. For brands, he noted, this same audience consumes fast-moving consumer goods (FMCG), fashion, live events, and music, making them commercially relevant far beyond gaming.

Reframing the India Entry Strategy

When international publishers or brands approach Scara Gaming to grow in India, George said the first step is segmentation, not scale.

He explained, “The beauty of gaming is that the target group is well defined. But each game has a different target group; even if they are from gaming, the same strategy does not work for all. We try to understand the insight of that target group and then approach them through their interests.”

He cited Konami’s eFootball as a case study. In an early campaign, Scara deployed gaming and esports influencers, assuming adjacency would translate into viewership. It did not.

George said, “We realized the Indian esports community prefers first-person shooter games like BGMI and Free Fire. When it came to eFootball, the viewership dropped because that was not what they were watching their heroes for.”

The pivot involved targeting football fans rather than general gaming audiences. The campaign expanded into sports and mainstream influencers, including cricketers and football personalities. According to George, this shift significantly improved engagement.

Scara Gaming on the BGMI Narrative and its Limits

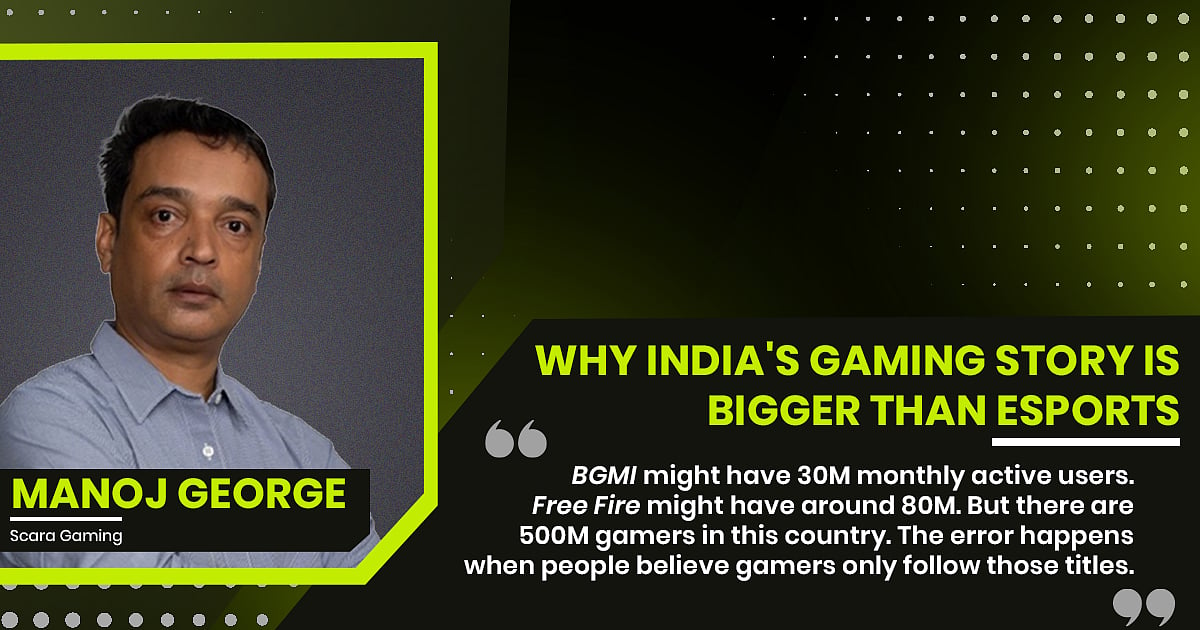

Industry shorthand frequently reduces Indian gaming to BGMI and Free Fire. George views that framing as incomplete.

He said, “BGMI might have 30M monthly active users. Free Fire might have around 80M. But there are 500M gamers in this country. The error happens when people believe gamers only follow those titles.”

He contextualized the current phase as an advocacy cycle, comparable to early digital advertising in India. George recalled pitching branded tweets in 2010 and being told the ecosystem was premature. He sees gaming in a similar position today.

George explained, “We are pitching to ten clients and closing hardly any because agencies and brands still do not fully understand this ecosystem. It is a new medium. Once the advocacy happens, the growth can be fast.”

He believes markets such as Indonesia and parts of South America provide a preview of where India could be headed once mainstream acceptance solidifies.

Average Revenue per User and Volume Economics

India’s lower average revenue per user (ARPU) compared to Indonesia or Middle East and North Africa (MENA) markets remains a recurring concern for publishers. George sees the solution in structural adaptation rather than market pessimism.

He said, “Microtransactions are what work in India. Fifteen-to-twenty-rupee kind of transactions are what people are comfortable with. Unified Payments Interface (UPI) has helped explode that ecosystem.”

George argued that India’s price sensitivity should not be misinterpreted as weak monetization potential. Instead, scale compensates for a lower ticket size.

He explained, “The transaction value might be lower, but the number of transactions will be much higher because of the size of the population. It is a price-sensitive market, so positioning has to reflect that.”

For publishers accustomed to higher ARPU markets, this requires recalibrating pricing tiers, reward loops, and payment friction assumptions.

Content Consumption and Influence Dynamics

Beyond gameplay, George described a robust content consumption layer surrounding Indian gaming.

He stated, “People are consuming a lot of content on YouTube, Shorts, and on social platforms while they play as well. The best thing about gaming content is that it is not scripted; it comes naturally. Every influencer has their own flavor.”

He pointed to large creator ecosystems where personality, relatability, and authenticity drive retention. For Scara, influencer selection extends beyond strictly gaming creators.

George explained, “When we say gaming, we also include pop culture. We use comedy influencers, lifestyle influencers, and actors. We look at what the target group’s interests are and build a strategy around that.”

This approach reframes gaming as one node within a broader cultural consumption network rather than an isolated vertical.

Scara Lite and the Tier Two Focus

Scara Lite extends this thesis into experiential territory.

“We are trying to create a pop culture experience where it is not only gaming. It will be music, comedy, food, fashion, and wellness. We want to create multiple touchpoints in one experience,” George said.

He compared the concept to large festivals where attendees engage selectively with headlining acts while spending the remainder of their time socially.

He added, “Imagine if that time was filled with curated experiences across gaming and culture. It creates better value for the consumer and more meaningful engagement opportunities for brands.”

Importantly, Scara is prioritizing tier-two and tier-three markets. As George explained, “Delhi, Mumbai, and Bangalore are overly supplied. We are looking at tier-two and tier-three markets where there is a large young audience whose interests lie in the same fields.”He views these markets as underactivated rather than underdeveloped.

Esports Economics and Structural Friction

On esports monetization, George distinguished publisher-funded properties and independent tournament organizers.

He acknowledged that Battlegrounds Mobile India Masters Series (BGMS) worked due to television integration and strong production value, but questioned how many other properties are sustainably profitable.

George explained, “Publisher-led tournaments are funded because the publisher has money to deploy. But are tournament organizers making money? Very few.”

He contrasted esports with traditional sports federations, noting, “Sports is run by federations. Esports is run by publishers. Publishers are in the business of making money. In esports, the team owner pays salaries, pays for bootcamp, and operations. If the team wins, they get a percentage of the prize. That is why it is a flawed ecosystem.”

He expressed cautious optimism that value distribution models may evolve, but stopped short of predicting near-term structural reform.

Scara Gaming on the Brand Conviction Problem

Despite increasing inbound briefs, George believes gaming remains one major proof of concept campaign away from broader brand conviction.

George said, “They are happy to create the experience. But when it comes to spending on distribution, they question it. In traditional advertising, brands do not question the cost of making the advertisement. They look at the media separately. In gaming, the experience is the campaign.” He added that gaming offers lower wastage and deeper engagement relative to broad media spends, but measurement frameworks have yet to fully mature in the eyes of large advertisers.

George concluded, “It is a matter of time. One strong proof of concept, and the shift will accelerate. We are here for the long haul.”

If he is right, the next phase of India’s gaming economy will not be defined by bigger prize pools or louder tournaments. It will be defined by who understands the everyday player and builds around them first.